The Costa Rica real estate board (CCCBR) located in San Jose, is starting a Property Price Index (IPP= Indice de Precios de la Propiedad) and promises to have the first progress on the Province of San Jose for the first quarter of 2013.

The Costa Rica real estate board (CCCBR) located in San Jose, is starting a Property Price Index (IPP= Indice de Precios de la Propiedad) and promises to have the first progress on the Province of San Jose for the first quarter of 2013.

This was reported by El Financiero, the leading financial newspaper of Costa Rica.

Mrs. Aleyda Bonilla, president of the CCCBR, says that this index will make the sellers of Costa Rica real estate to register the real prices of their properties. Once that happens, they will receive a just price from the buyers.

At the same time, she continues, this index will offer information on the size of the Costa Rica real estate market. The index will allow buyers, banks, municipalities, National Registry, and the Treasury to use a database to calculate prices by geographic area and type of land.

The Property Price Index will show important data as

- registered value,

- tax value,

- municipal value,

- amount of a mortgage

- and the real market cost of the property.

Inside Costa Rica reported misinformation and miscalculations in real estate appraisals in Costa Rica have driven the CCCBR to create the first Property Price Index in the country.

Property Price Index

No matter the reason to start the Property Price Index, I applaud the effort made by Mrs. Bonilla and her board members. The index they propose is the first effort made by organized Costa Rica real estate agents to use the information that will be publicly available for the first time since the approval of the new law No. 9069 by the Costa Rican Legislature.

Law No. 9069 is the Ley de Fortalecimiento de la Gestión Tributaria, a law that was made to make tax management easier for the Costarican Treasury. This law modifies the existing law on real estate transfer taxes (Ley de Impuesto Sobre el Traspaso de Bienes Inmuebles Ley No. 6999).

Costa Rica Property Transfer Tax Law

The Costa Rica Property Transfer Tax Law provides that all transfers of property recorded in the National Registry are subject to a 1.5% transfer tax.

A transfer will trigger registration fees and documentary stamps in addition. This adds to the transaction costs as well. The new law aims at pursuing these indirect transfers.

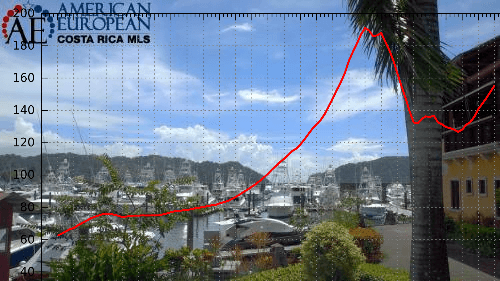

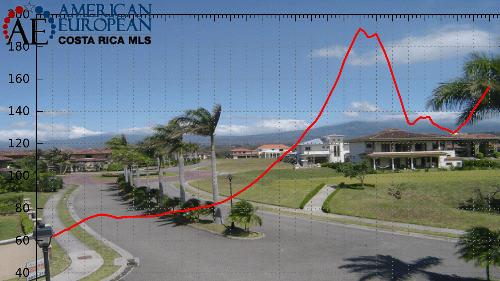

The Costarican Real Estate market

Therefore, in my opinion, it is not the CCCBR’s effort that will make the sellers of property in Costa Rica to register the real prices but the new law 9069. The board’s effort might help the Costa Rican real estate market to get organized as follows:

Correct asking price

Directing sellers to set the asking prices near real market values (through Comparative Market Analysis. So hopefully there will be no more overpriced property in Costa Rica.

Be competitive

Obliging the sellers to have their property show as well as possible to be competitive.

Differentiate motivated sellers

Buyers can see which seller is a motivated seller and which one is not.

Professionalization of agents

Obliging real estate agents, no matter if they are a member of the CCCBR or not, to become more professional and better informed.

Stop overpricing of property

Stopping crooked realtors and attorneys to charge overprice on properties sold to unknowing local and foreign buyers. Some have the bad habit of keeping the difference between the price paid by the buyer and the price received by the seller.

Stop illegals from working as agents

Stopping non-resident so-called real estate agents (illegals), taxi drivers and bartenders to earn a real estate commission. They are not paying taxes on their commissions. Local agents will have to get a better education and therefore be more responsible for their mistakes.

Correct registration fo sales price

Obliging the Municipalities and the National Registry eventually to agree on the real values of the properties.

Tax for Real estate developers

Obliging every Costa Rica real estate developer to share in the responsibility of paying taxes. Now they will have to show their sales and pay income tax. Also, their buyers will have to pay the real estate transfer tax.

Correct property tax charges

Both the national government, as well as the local government, will receive taxes calculated by the real value of the properties. This, in turn, will generate in better roads, better bridges, and maintenance of Costa Rica’s infrastructure. WE HOPE.

I wish Mrs. Bonilla and her directives luck in her new project. In my personal opinion, they will only be able to make the Property Price Index functional for comparable properties like condominiums.

Feel free to leave your comments on this blog. If you like this article, please feel free to share it on your social media.

If you like this blog, connect with me on Google+ or subscribe to our newsletter by clicking the banner below.

While we’re at it, I DO want to remind our readers that we appreciate any referrals you can send us. Finally, please remember the American-European real estate Group’s agents when you refer a real estate agent. Because we DO appreciate your business.